Navigating your savings during volatile markets

Market volatility can startle even the most experienced investors. No matter where you are on your retirement path, it’s important to keep the following in mind when deciding whether or not to remain invested.

New contributions may grow after market volatility

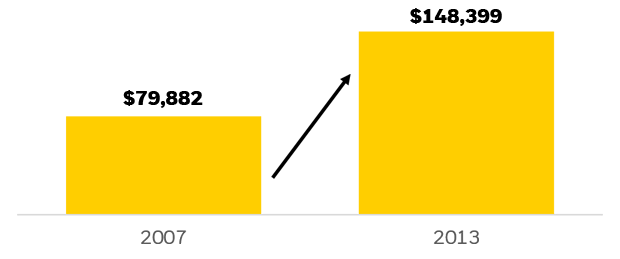

Investors who can continue contributing to their retirement have the potential to take advantage of market recoveries. For example, those who stayed in their plan from 2022 through 2024 saw their average account balances increase by 86%1.

New contributions can take advantage of attractive pricing as the markets recover.

Your assets are secure by design

Our team is accredited by top financial institutions, guaranteeing that we meet the highest standards of investment management and fiduciary duty.

Our Investment Plan

STANDARD PLAN

- Minimum Deposit $100

- Maximum Deposit $5,000

- 24/7 Dedicated support

- Highly secured

- Referral bonus 5%

8%

AFTER 24 HOURS

SILVER PLAN

- Minimum Deposit $1,000

- Maximum Deposit $10,000

- 24/7 Dedicated support

- Highly secured

- Referral bonus 5%

12%

AFTER 24 HOURS

GOLD PLAN

- Minimum Deposit $3,000

- Maximum Deposit $30,000

- 24/7 Dedicated support

- Highly secured

- Referral bonus 5%

16%

AFTER 24 HOURS

DIAMOND VIP PLAN

- Minimum Deposit $5,000

- Maximum Deposit Unlimited

- 24/7 Dedicated support

- Highly secured

- Referral bonus 5%

20%

AFTER 24 HOURS

Staying invested in market downturns

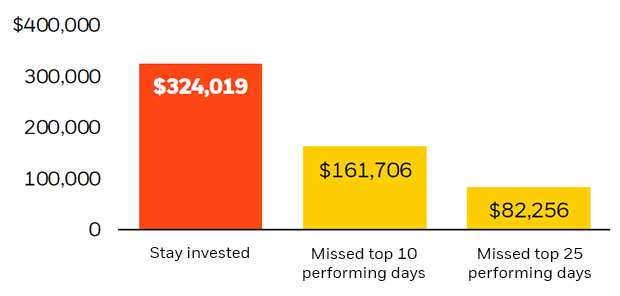

Historically, market rebounds are concentrated in a few distinct spurts. We expect the market to rebound again, but we can’t know exactly when that will happen.

Consider the above chart, which shows the hypothetical return of $100K invested in the S&P 500 Index from March 2021 to February 2024 (yellow bar). To the right, you can see the impact of having missed top-performing days. Staying invested earned more than double that of the portfolio which missed the top 10 performing days.

Start your journey to financial freedom with BitBlossom

Bitblossom

Your financial success is our top priority. Our team of experts is dedicated to offering innovative investment solutions customized to your needs. Invest with us today and see the difference for yourself

Useful links

Contact Us

- support@bitblossom.org

- help@bitblossom.org

- Live Chart